PTA Tax Reduced FBR Announces Major Relief

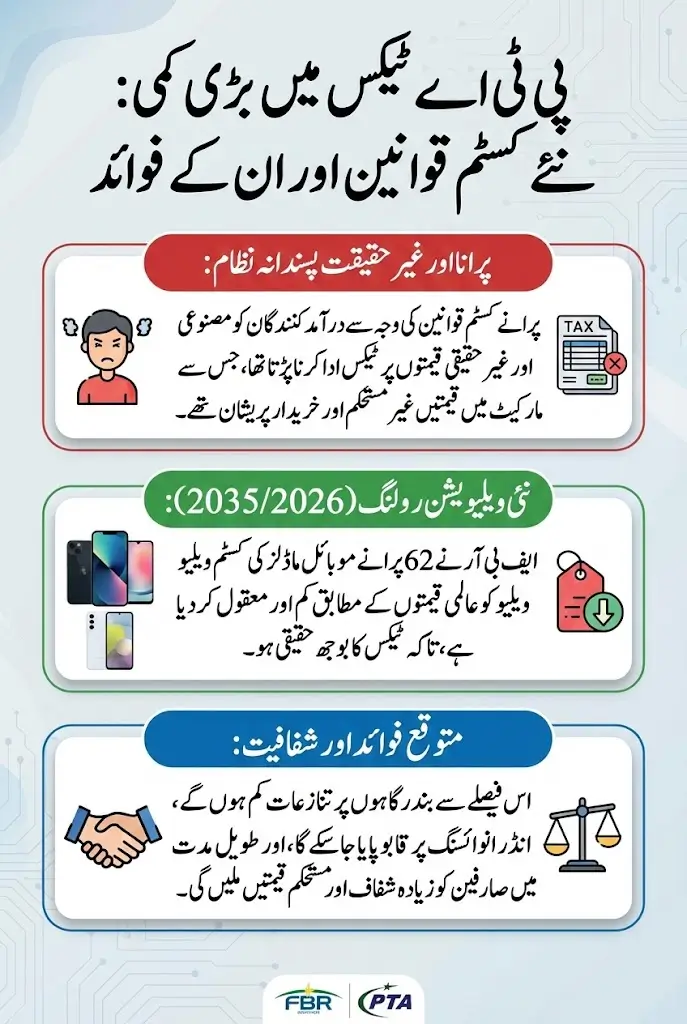

PTA Tax Reduced FBR Announces Major Relief Federal Board of Revenue (FBR), in coordination with the Directorate General of Customs Valuation Karachi, has announced a major revision in customs values related to PTA taxes on imported mobile phones. This decision is being described as a significant relief for the used mobile phone market in Pakistan, where prices have remained unstable for a long time due to outdated valuation rules.

As someone who regularly observes mobile markets and speaks with traders, it was clear that the old system was no longer workable. Importers were paying duties on unrealistic values, while buyers were confused about sudden price changes. The new valuation is an attempt to bring the system closer to ground realities and international market trends.

You Can Also Read: PM Laptop Scheme 2026 Reapplication

Government Announces Big Relief for Imported Mobile Phones

This relief mainly comes through the reduction and rationalization of customs values, which directly affect PTA-linked taxes. When customs values are reduced or aligned with real prices, the total tax burden automatically becomes more reasonable. This is why the announcement has been welcomed by importers and traders across major cities.

In Pakistan, a large segment of the population relies on used mobile phones because new devices are often unaffordable. Any correction in import taxation plays a direct role in shaping market prices. This step does not promise instant cheap phones, but it does remove one of the biggest distortions in pricing.

Key points of the government relief include:

- Revision of customs values for used mobile phones

- Alignment of PTA-related taxes with global prices

- Focus on transparency rather than arbitrary assessments

- Relief targeted at commercial import channels

You Can Also Read: 8171 Payment Update: Rs. 14,500 Messages Officially

Why Customs Values Were Changed After a Long Time

Customs officials clarified that the previous valuation ruling had been in place for more than one and a half years. During this period, the international smartphone market changed rapidly. New models were launched, while many older models lost value or were discontinued entirely.

From a practical perspective, Pakistan was charging taxes based on prices that no longer existed globally. This gap created unnecessary pressure on importers and encouraged under-invoicing. The revised values are meant to reflect actual depreciation and current market demand.

The main reasons behind revising the values were:

- Old valuations no longer matched international prices

- Several phone models reached end-of-life stage

- Increased gap between declared and actual values

- Growing complaints from stakeholders

You Can Also Read: BISP Payment Update: CNIC Renewal Rules

New Valuation Ruling Issued by Customs Karachi

To implement these changes formally, the Directorate issued Valuation Ruling No. 2035 of 2026. This ruling covers 62 types of old and used branded mobile phones and is applicable nationwide. It provides a fixed reference for customs officers when assessing duties and taxes.

In my experience of covering customs-related issues, lack of clarity often leads to disputes at ports. This ruling reduces discretionary powers and gives both importers and officers a common benchmark to follow.

Imported Phones Covered Under the New Decision

The revised valuation strictly applies to used mobile phones imported for commercial purposes, without boxes or accessories. This detail is important because it clearly separates commercial imports from passenger baggage and personal-use phones.

By limiting the scope, customs authorities aim to prevent misuse of the policy while ensuring genuine trade benefits from the revised system. Importers dealing in bulk used phones are the primary beneficiaries of this change.

You Can Also Read: 8171 Payment SIM Verification Through Tehsil Office

Major Mobile Brands Included in the Relief

The relief focuses on four major brands that dominate Pakistan’s used mobile phone market. These brands are commonly found in wholesale markets and retail shops across the country.

Because these brands make up a large share of imports, revising their values has a noticeable impact on the overall market. Buyers looking for reliable used phones are most likely to feel the effects of this policy over time.

The included brands are:

- Apple iPhone

- Samsung Galaxy

- Google Pixel

- OnePlus

You Can Also Read: Hunarmand Nawaz Program Brings Paid Digital Skills

How New Customs Values Will Be Applied

Under the new system, customs duties and taxes will be calculated based on fixed customs values provided in the ruling. The physical condition, cosmetic wear, or battery health of the phone will not change the assessed value.

This approach simplifies the clearance process and reduces arguments at customs. While some traders may feel it ignores phone condition, overall it creates consistency and predictability in tax calculations.

Activation Rule Every Importer Must Follow

One strict condition under the ruling is the activation requirement. Imported used mobile phones must have been activated at least six months before export to Pakistan. This rule exists to stop near-new phones from being declared as used.

Importers are required to declare the activation period, and customs officers will verify this information during assessment. This step strengthens compliance and protects the intent of the policy.

You Can Also Read: BISP Payment Update January 2026: Q2 Installment

Customs Values Snapshot for Popular Used Mobile Phones

To help readers understand how values have been adjusted, below is a combined snapshot of customs values for selected popular models across different brands. These figures represent C&F values in US dollars and are used to calculate duties and taxes.

| Brand & Model | Customs Value (US$ C&F) |

|---|---|

| iPhone 15 Pro Max | 460 |

| iPhone 13 | 170 |

| iPhone 11 | 95 |

| Samsung Galaxy S23 Ultra | 255 |

| Samsung Galaxy S21 5G | 50 |

| Google Pixel 9 Pro XL | 260 |

| Google Pixel 7 | 59 |

| OnePlus 12 | 184 |

| OnePlus 11 | 92 |

These values reflect international depreciation trends and are expected to reduce unrealistic duty demands.

How This Step Will Control Under-Invoicing

One of the main objectives of this valuation exercise is to control under-invoicing. Customs authorities found wide differences between declared import values and actual market prices during data analysis and market surveys.

By enforcing fixed values, customs officers no longer rely solely on importer declarations. This reduces manipulation, improves documentation standards, and ensures fair competition among traders.

Expected Impact on Prices and Government Revenue

In the short term, the biggest benefit will be smoother clearance and fewer disputes at ports. Importers will know in advance how much duty they have to pay, which improves planning and reduces delays.

For the government, accurate valuation means better revenue collection without increasing tax rates. For consumers, the impact may be gradual, but price stability and transparency are expected to improve over time.

What Importers and Buyers Should Do Now

Importers should carefully review Valuation Ruling No. 2035 of 2026 and ensure full compliance with activation and declaration requirements. Proper paperwork will help avoid penalties and clearance issues.

Buyers should stay informed and compare market prices wisely. While this policy does not guarantee cheap phones overnight, it lays the foundation for a fairer and more realistic used mobile phone market in Pakistan.