SBP Financial Inclusion Index

SBP Financial Inclusion Index State Bank of Pakistan (SBP) has launched the Pakistan Financial Inclusion Index (P-FII), a landmark initiative designed to measure how accessible and effective financial services are across the country. Financial inclusion has become a key driver of economic growth, as it allows citizens to participate in the financial system through bank accounts, digital payments, and loans. The P-FII provides a comprehensive assessment, offering a clear snapshot of Pakistan’s current financial landscape and identifying areas that require improvement.

For ordinary Pakistanis, financial inclusion means more than having a bank account. It is about easy access to quality banking, microfinance, and digital payment services that are reliable, secure, and affordable. By introducing this index, SBP aims to ensure that financial opportunities reach every corner of the country, from urban centers to remote villages, promoting economic participation for all citizens.

You Can Also Read: PSO Petrol Price In Pakistan Today: Latest Reduction

Why SBP Launched the P-FII

Improving financial inclusion is one of the core mandates of the SBP Act, 1956, and the P-FII represents a major step toward achieving this goal. The index allows the central bank to monitor progress systematically and make informed policy decisions. In the era of digital banking, fintech solutions, and growing mobile wallet usage in Pakistan, a reliable tool to track access, usage, and quality of financial services was necessary.

By establishing a comprehensive index, SBP now has evidence-based insights into the challenges citizens face. Whether it is a lack of ATMs in rural areas, limited access to microloans, or low usage of digital payment systems, the P-FII highlights critical gaps in Pakistan’s financial ecosystem, allowing policymakers to address them effectively.

You Can Also Read: 8171 Tracking Portal 2026 To Check BISP Payment

Understanding the P-FII Score

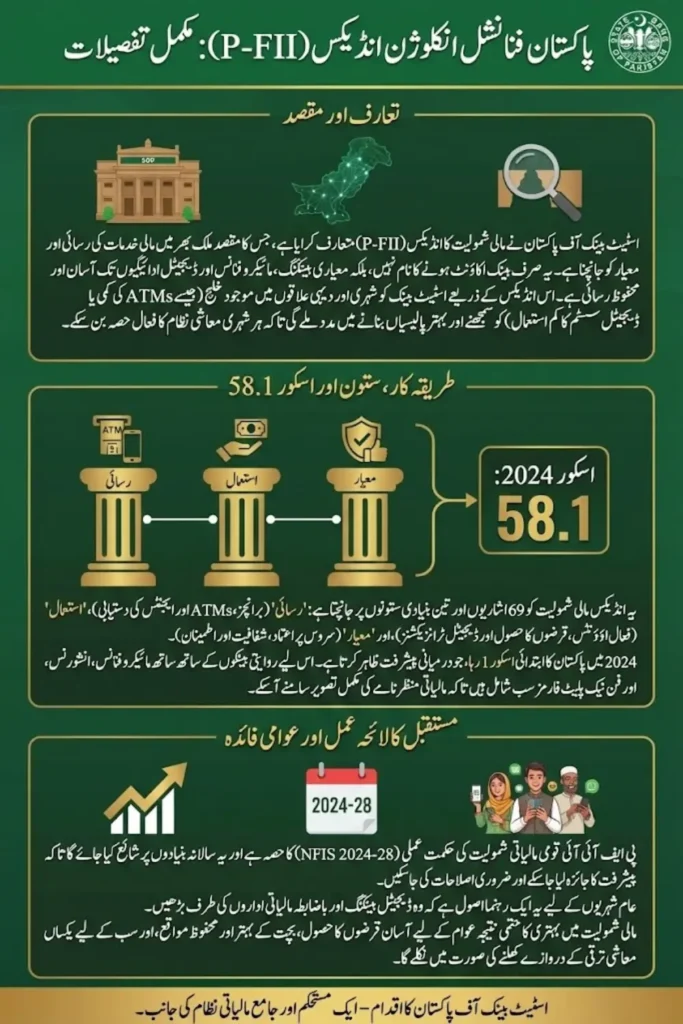

According to the first results, Pakistan’s overall financial inclusion score stood at 58.1 in 2024. This score reflects the country’s moderate progress in expanding financial access and improving the quality of services. While the number shows that millions of Pakistanis are now part of the financial system, it also indicates significant room for improvement, especially in under-served areas.

The P-FII score is a benchmark, helping SBP and financial institutions track progress over time. A rising score in future years would signify that more people are using financial services effectively and that these services are of higher quality.

You Can Also Read: Punjab Bait-ul-Maal 2025 Assistance for Housing

Key Areas Measured in the Index

The P-FII evaluates financial inclusion across three main pillars:

- Access: Availability of bank branches, mobile agents, ATMs, and digital services.

- Usage: Active participation in banking and payment services, including loans, savings, and transactions.

- Quality: Reliability, security, transparency, and customer satisfaction with financial services.

This comprehensive approach ensures that the index is not just about presence of services but meaningful usage, which directly impacts economic growth and financial empowerment.

Coverage of Financial Services in the Index

The P-FII covers a wide spectrum of services:

- Banking services: Conventional banks, microfinance banks, and regional banks.

- Non-banking financial institutions: Insurance providers, microfinance organizations, and cooperatives.

- Payment and digital services: Mobile wallets, online banking, and fintech platforms.

By including all these categories, SBP ensures that the index reflects the true financial experience of citizens, whether they live in cities or rural areas.

You Can Also Read: 8171 Payment Location 2026 For Withdrawal

How the P-FII is Calculated

The P-FII uses 69 indicators covering infrastructure, usage, and quality of financial services. Infrastructure indicators include the number of bank branches, ATMs, and mobile banking agents per region, while usage indicators measure active accounts, loan uptake, and digital transactions. Quality indicators assess customer satisfaction, transparency, and service reliability.

Core Indicators of P-FII

| Pillar | Example Indicators |

|---|---|

| Access | Bank branches per 100,000 adults, ATM availability |

| Usage | Active accounts, loan uptake, digital transactions |

| Quality | Customer satisfaction, complaint resolution, service reliability |

This approach allows SBP to capture the full picture of financial inclusion, going beyond mere access to measure actual participation and service effectiveness.

You Can Also Read: NADRA B Form 2026 Complete Guide to Fees

Connection with NFIS 2024–28

The National Financial Inclusion Strategy (NFIS) 2024–28 guides SBP’s efforts to expand access and improve quality of financial services. The P-FII serves as a monitoring and evaluation tool, helping policymakers track progress toward NFIS targets. By analyzing index results, SBP can fine-tune policies, prioritize reforms, and allocate resources where they are most needed.

Development and Research Behind the P-FII

The P-FII was developed after extensive research starting in 2023. SBP studied global financial inclusion indices, learning from best practices used by central banks and multilateral organizations worldwide. The research focused on adapting these methods to Pakistan’s unique financial environment, ensuring the index is practical, accurate, and reflective of local needs.

Consultations were held with domestic and international stakeholders, including banks, financial institutions, researchers, and policy experts. Their input helped refine the methodology, ensuring the P-FII represents real-world financial experiences of Pakistanis.

You Can Also Read: 8123 Ehsaas Rashan Program 2026 Registration

Future Use of the P-FII

SBP intends to publish the P-FII annually, offering a regular update on the state of financial inclusion in Pakistan. The index will:

- Track year-on-year improvements

- Highlight areas needing policy intervention

- Promote transparency and accountability in the financial sector

This annual reporting ensures that the index is a living tool, helping policymakers, financial institutions, and citizens understand progress and challenges in real-time.

Importance for Pakistani Citizens

For ordinary citizens, the P-FII can be a useful guide to understand how financial services are evolving in Pakistan. It encourages people to explore digital banking, mobile wallets, and formal financial institutions, while also ensuring they receive quality services. Greater financial inclusion ultimately means easier access to credit, better savings options, and improved economic opportunities for all Pakistanis.

Conclusion

The launch of the Pakistan Financial Inclusion Index (P-FII) is a major milestone in building a more inclusive financial system. With an initial score of 58.1, the journey toward full inclusion is ongoing, and the index provides a clear roadmap for the future. By combining international best practices, extensive research, and stakeholder feedback, SBP has created a tool that will guide policy, track progress, and empower citizens over the coming years.