Asaan Karobar Eligibility Criteria

Asaan Karobar Eligibility Criteria is one of Punjab’s most impactful initiatives, designed to provide interest-free loans to individuals who want to start or expand their businesses. Many people across the province have strong business ideas but lack financial support. This scheme directly targets that gap by offering interest-free and subsidized loans so that entrepreneurs can confidently begin their business journey. It supports startups, small businesses, and medium enterprises without unnecessary paperwork or complicated procedures.

The purpose of this guide is to provide clear, simple, and complete information about the eligibility criteria, required documents, application method, and approval process. Whether you are a fresh graduate, a skilled worker, or someone planning to scale an existing business, this article will help you understand exactly how to apply and succeed under the Asaan Karobar Loan Scheme 2025.

This loan program also helps boost employment opportunities. When small businesses grow, they employ more people, contribute to local markets, and play a role in stabilizing Pakistan’s economy. The government’s focus is not only financial assistance but long-term economic development, making this scheme a major step toward youth empowerment and innovative business growth.

You Can Also Read: Verify Your November 2025 Bisp Payment Of Rs. 13,500

Understanding the Purpose of Asaan Karobar Loan Scheme 2025

The core purpose of the Asaan Karobar Scheme is to encourage entrepreneurship by making financial resources accessible to the public. In a time when job opportunities are limited, many young people want to create their own sources of income. However, high-interest loans and lack of initial capital usually stop them from taking the first step. The interest-free option solves this challenge by giving financial breathing room at the start of a new venture.

Another major objective is to support businesses in sectors that directly contribute to the economy. These include IT, retail, agriculture, services, manufacturing, and several other categories. By supporting such sectors, the scheme ensures that the growth is sustainable and creates long-term employment opportunities. This program not only strengthens individuals but helps stabilize economic activity across the province.

A key advantage of this scheme is that the loan processing is transparent and backed by the Punjab government. Applicants do not need to worry about unfair deductions or unauthorized middlemen. The entire system is linked to verified banks, strict documentation checks, and government monitoring, which ensures honest use of funds.

You Can Also Read: Punjab Schools Introduce New Winter Timings

Quick Snapshot of Without Interest Loan Features

Below is a simple overview of the key features of the interest-free loan categories:

- Interest-free loans for approved business categories

- Government-backed loan security and verification

- Loan amounts increasing according to the business scale

- Easy digital application system

These features make the scheme accessible, practical, and highly beneficial for new and developing entrepreneurs.

You Can Also Read: BISP Wallet Sim 8171 Activation for Jazz & Telenor

Eligibility Criteria for Asaan Karobar Without Interest Loan

Eligibility is the most important part of the application process. The government has set simple and fair rules that allow maximum participation. These rules ensure that applicants are serious, capable, and genuinely interested in starting a business. Applicants who prepare according to the criteria face fewer hurdles during verification.

The criteria also aim to support educated youth, technical workers, and individuals with skill-based business ideas. People belonging to rural and urban areas can apply, as the program covers a wide variety of business sectors. Women entrepreneurs receive special preference because the government wants more women to enter business and create economic stability in their households.

You Can Also Read: BISP Re-verification 2025 For December Payment

Here is the only table included naturally in the article, summarizing complete eligibility requirements:

| Criterion | Requirement |

|---|---|

| Citizenship | Must be Pakistani with valid CNIC |

| Residence | Permanent resident of Punjab |

| Age Limit | 21–45 years (minimum 18 for IT & E-commerce) |

| Qualification | College degree or technical/vocational diploma |

| Business Type | New startups or existing small & medium businesses |

| Preference | Innovative, scalable ideas with job creation potential |

This simple structure makes it easy to evaluate whether you qualify before applying.

Required Documents for Applying

Document submission is a major part of the loan approval process. Proper documents help the bank verify your identity, qualifications, and business goals. Applicants should prepare high-quality scanned copies of each document before applying online. Ensuring accuracy at this stage helps avoid delays because banks reject applications that have unclear, mismatched, or incomplete documentation.

Your documents must match the data written in the application form. Even a small mistake, such as spelling differences or outdated information, can cause delays. It’s better to update your CNIC details, address, and education record beforehand. Existing business owners may be asked to provide additional details related to income, tax status, or business operations.

Here is the complete checklist of required documents:

- CNIC copy (front and back)

- Proof of residence (domicile or utility bill)

- Educational degrees or vocational certificates

- Passport-size digital photo

- Business plan or feasibility report

- Bank statement (if requested)

- NTN certificate (optional but beneficial)

- Experience documents for existing business owners

These documents help establish your identity and prove your readiness for the loan.

You Can Also Read: BISP Wallet SIM 8171 Complete Guide 13500 Installment

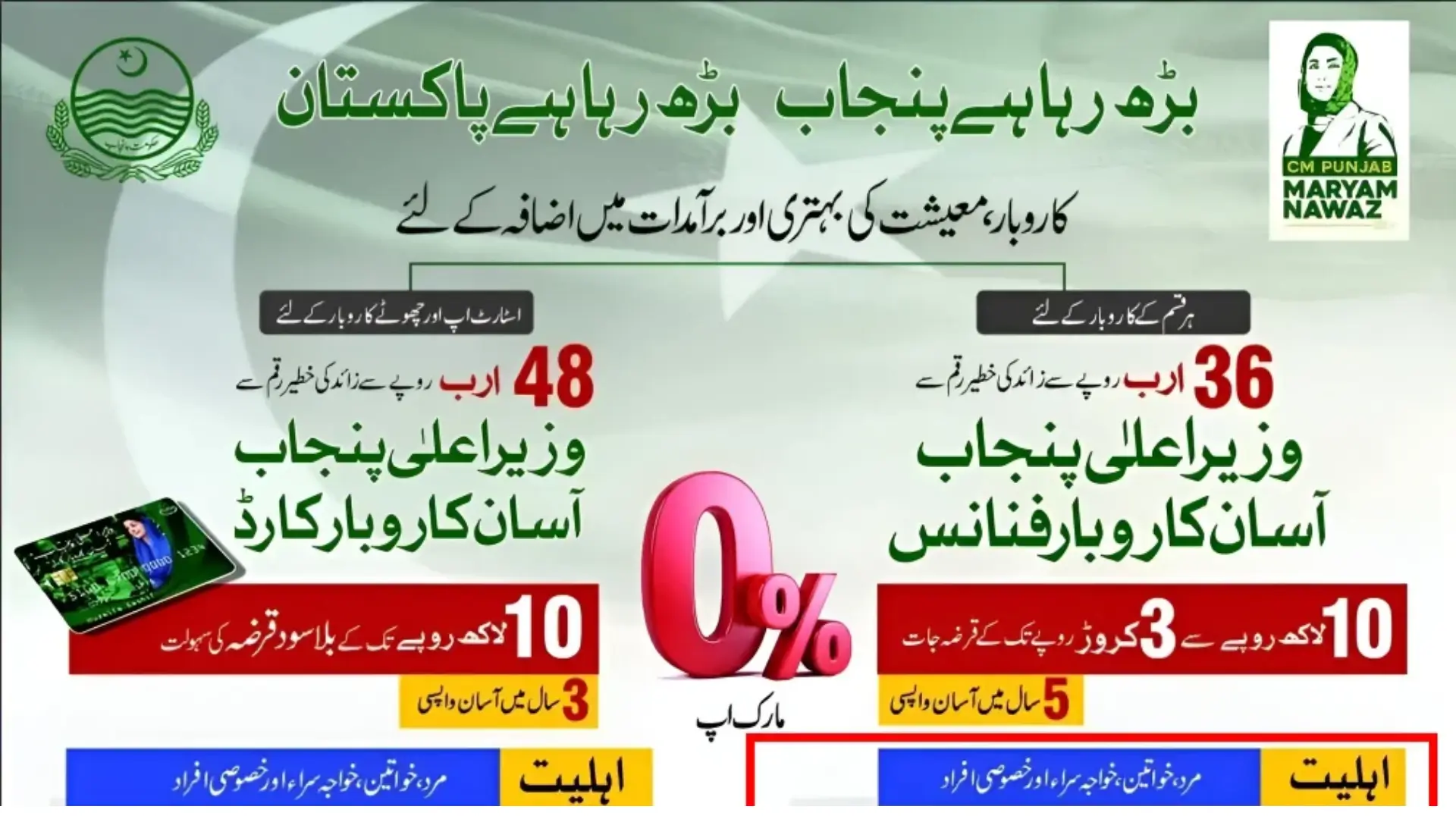

Loan Categories & Interest-Free Structure Explained

The Asaan Karobar Scheme has several loan categories designed for different types of businesses. The interest-free category is usually aimed at smaller or early-stage businesses that need initial capital. The subsidized categories support medium- and large-scale operations where more funds are required. Understanding these categories helps you pick the correct loan type for your business plan.

Interest-free loans are especially beneficial for individuals who want to start micro businesses such as online stores, small shops, agriculture units, service centers, or IT-based startups. These categories do not require markup, helping entrepreneurs focus fully on business growth. Subsidized loans, although not fully interest-free, still offer very affordable repayment plans supported by the government.

Below are the general types of loan categories:

- Tier 1: Interest-free small loans for early-stage businesses

- Tier 2: Subsidized loans for medium-sized operations

- Tier 3: Larger loans with low markup and equity requirements

- Maximum loan limit: Up to Rs. 30 million

These tiers ensure that every level of entrepreneur receives assistance.

You Can Also Read: Sarsabz Punjab Scheme 2025 Details Online Apply

Step-by-Step Application Process – Full Guide 2025

Applying correctly is essential for faster approval. The government has simplified the entire application procedure so anyone with basic digital skills can complete it. The online portal collects your details, verifies documents, and forwards information to the partner bank. Ensuring accuracy in every step helps you avoid delays.

Once your application is submitted online, the bank reviews your information and notifies you if any document is missing. After basic verification, the bank checks your business feasibility and financial background. Applicants with complete documents and a clear business plan are usually approved faster.

Follow these steps to apply successfully:

- Register Online

Visit the Punjab government’s official portal and create an account. Submit accurate personal, educational, and business details. - Upload All Required Documents

Attach CNIC, business plan, degrees, residence proof, and other documents. - Bank Verification Process

The bank analyzes your feasibility, reviews financial history, and checks your eligibility. - Equity or Collateral Review

Depending on your loan category, you may need to show equity or minimal collateral. - Loan Approval & Disbursement

After verification, the loan is approved and transferred directly to your bank account.

Following these steps increases the chances of quick and successful loan disbursement.

You Can Also Read: BISP Wallet Registration 2025: Secure Payment

Bank Verification, Equity, and Collateral Requirements

Bank verification is a major step where your identity, financial background, and business feasibility are analyzed. The bank evaluates your ability to run the business successfully. This includes checking whether you have basic financial stability, a good credit history, and a realistic business model. Applicants with overdue loans or ECIB issues may face delays or rejection.

Equity requirements depend on the loan category. Smaller interest-free loans often do not require equity. However, medium and large loans may need around 20% equity, proving that the applicant is genuinely committed to the project. Collateral is also only required for larger loans, usually in the form of property documents or business assets.

Applicants must show that they can manage the business responsibly and repay the loan on time. Keeping your bank record clean and maintaining proper documentation greatly helps during this stage.

You Can Also Read: 8171 Tracking Portal Status Check Portal Validation

Sectors Supported Under Asaan Karobar Scheme

The Asaan Karobar Scheme covers multiple sectors to ensure equal opportunities for applicants from different fields. This diversity supports Punjab’s overall economic development by promoting growth across industries. Whether you live in a city or a rural area, you can choose a business category that suits your skills, experience, and goals.

The government specially encourages businesses that create jobs, promote innovation, and have long-term sustainability. Many applicants choose agriculture, IT, and retail businesses because these fields offer steady income and fast growth. Women entrepreneurs are also encouraged to apply, especially in services, retail, and health sectors.

Some common sectors supported under the scheme include:

- IT and E-Commerce

- Retail and Services

- Agriculture and Livestock

- Manufacturing and Cottage Industry

- Education and Health-related businesses

This wide sectoral coverage ensures that the scheme benefits both skilled and unskilled individuals.

Common Rejection Reasons & How to Avoid Them

Rejections usually happen because of avoidable mistakes. Applicants who understand these mistakes can significantly increase their chances of approval. Banks focus on complete documentation, clean financial records, and strong business feasibility. Even a minor error can delay the verification process.

Many applicants also fail because they do not follow the eligibility age, education, or residency requirements. Some individuals upload unclear or unreadable documents, which leads to automatic disqualification. A strong and practical business plan plays a major role in the approval decision.

Here are the most common reasons for rejection:

- Missing or mismatched documents

- Weak or unclear business plan

- Poor financial history or unpaid loans

- Incomplete information in the online application

- Lack of equity for required categories

Avoiding these mistakes reflects your seriousness and increases approval chances.

Tips to Strengthen Your Loan Application

A strong application reflects preparation and commitment. Applicants should take time to develop a high-quality business plan that clearly explains the idea, target market, expected revenue, and cost structure. The easier it is for the bank to understand your project, the faster your approval will be.

Organizing your documents in digital format and scanning them properly also creates a positive impression. A neat file shows professionalism and reduces the workload for bank officers during verification. Additionally, consider practicing your business explanation in case the bank calls you for an interview.

Below are some helpful tips:

- Use a professional business plan format

- Highlight job creation and innovation in your proposal

- Maintain a clean bank record

- Apply early because funds are limited

- Attend online workshops related to entrepreneurship

These improvements significantly boost your chances during the evaluation process.

FAQs

Who can apply for interest-free Asaan Karobar loan?

Any Pakistani citizen aged 21–45 (18 for IT), living in Punjab, with education and a valid business idea.

What is the maximum loan amount?

The scheme offers loans up to Rs. 30 million depending on business type.

Are all loans interest-free?

Only selected categories are fully interest-free; others have subsidized markup.

Can women apply?

Yes, and they receive special preference under the scheme.

How long does approval take?

Usually between 4 to 6 weeks after verification.

Conclusion

The Asaan Karobar Loan Scheme 2025 is a life-changing opportunity for people who want to start or expand their businesses but lack financial resources. With clear eligibility rules, interest-free options, step-by-step guidance, and government-backed financial security, this program allows entrepreneurs to confidently build their future. Applicants who prepare strong documents and follow each step carefully can benefit quickly and start their journey toward successful business ownership.